NEWSLETTER

Wpisz swój adres e-mail i zyskaj e-booka

Bez niechcianej poczty ani reklam

Tylko merytoryczne treści z obszaru digitalizacji produkcji

PMI for industry – despite the fact that the acronym sounds quite technical and seems to require a commitment to analyzing what is happening in the financial markets to understand it. In fact, the indicator is largely derived from emotion, speculation and a subjective approach to understanding one’s current position on the map of global exchanges of goods and services. I would like to present what this indicator is, how to interpret it and show why it is so important.

PMI when expanded is Purchasing Managers Index. It shows with what activity managers purchase goods and services in the market. It is considered by many people (including myself), as one of the parameters that can be used to predict the health of the economy in the near future (a leading indicator) with a direct bearing on the country’s GDP.

The PMI can theoretically take values from 0 to 100, but in practice it oscillates around 50. It is then possible to distinguish three states and give them some context based on the preceding states (it is also worth taking into account the actual economic situation in the market and back it up with direct experience and sources to draw long-term conclusions).

Value <0 – 50) – shows reduction in economic activity (reduction in spending and investment by production facilities).

Value <50> – we have no improvement or deterioration from the previous state.

Value (50,100> – we are dealing with increased economic activity (greater willingness to invest and spend money).

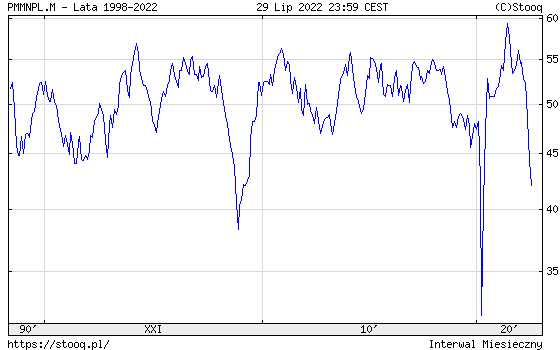

Below is a chart that shows the course of the Polish Managerial Purchasing Activity Index for the period from 1998 to 2022 (full version available here).

According to the data presented, over the past 24 years (since the measurement has been made), usually the PMI has been between 50 and 55 for our industrial sector, meaning positive sentiment. In a nutshell, it can be said that a PMI above 50 yields growth, investment and consequently, after time, an increase in GDP.

Going into more detail, to prove the thesis presented all the more, it is enough to look out the window and compare the picture from today (the effect of long-term development and increased activity) to what we saw back in 1998….

What we are dealing with now is a sharp drop in sentiment (related to employment, the state of industrial production, order quantities, spending on ancillary services) by 10 points from what it was in April 2022.

Why don’t production managers spend money?

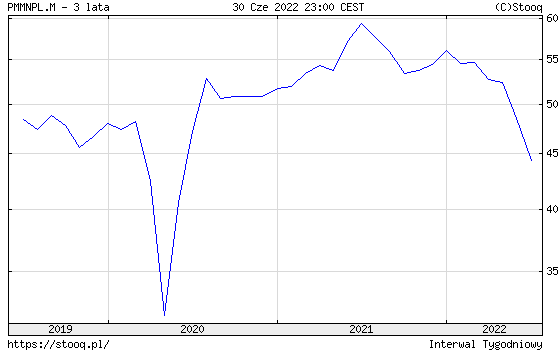

The reduction in managers’ willingness to spend money is, in my opinion, primarily related to high uncertainty. In the past two years, there has been incredible volatility in sentiment and the adoption of alternating states of optimism and pessimism.

We finally went from a historical minimum (since the first lockdowns broke out in Poland – March 2022, where the April 1, 2020 reading showed 31.90) to a historical maximum (June 2021 reading of 59.40).

Below is the period from June 2019 to June 2022 (full chart at stooq).

Of course, causes are strongly linked to effects, which drives the loops of increased uncertainty all the more, resulting in lower PMIs in the next reading period.

The reading itself is done by anonymous surveys, which are conducted once a month among managers who have direct influence on the company’s purchases. Despite the fact that the result is received with some delay (first there is a decision to abandon, for example, a new investment, then it is included in the survey), it is in any case ahead of other macroeconomic indicators. Worse sentiment causes a reduction in purchases, and these in turn affect less company activity, which contributes to a reduction in revenue. On a macro level, this results in a decline in the activity of the entire sector, which in the case of Poland accounts for one-third of our economy (indirectly, probably for more than half).

Let’s assume that a manufacturing company is planning a large investment in the area of implementing another machine that can increase production volume. In normal times, a loan would be taken out for the investment, and the profits from production would be enough to more than cover the interest.

Sentiment?

Positive… Finally the company is growing, hiring more people (all the infrastructure must be built around the machine).

And now a situation in which a machine was in the plans for implementation for a given year, but due to, for example, too high a cost of raising capital, a decision is made that the investment is not realized. In addition, a shortage of raw materials (for example) means that, in any case, the machine could not reach full capacity in the near future.

What in such a situation?

The machine was not purchased…

Consequently, he is not hired:

As a result, the revenue of each related business will not increase. The country’s GDP will not change in the area in question. This is a micro-scale example (after all, we are talking about one machine), but it shows a certain economic mechanism that is scalable, and if it occurs in more cases, it will affect the PMI.

The more expensive the money or the greater the uncertainty about the near future, the longer we think about how to spend it well… We go back to planning for necessary expenses and those that can be delayed a bit (in anticipation of better times).

Another issue is that, for example, we are beginning to pay more attention to what kind of inventory we have, whether we are able, given current cashflow and the dynamics of changing expenses, to exist safely. In other words, we are going back to the basics of the pyramid of needs and paying more attention to long-term survival at the expense of, for example, development or improving our quality of life.

It’s the same in business…

In business, first and foremost, the principle associated with return on investment works. If it’s relatively easy (cheap) to raise capital, it doesn’t take long to think between several ways of placing it. If capital is limited, as we end up with limited resources and a line of credit costs too much, we are guided much more often by ROI, i.e. calculation of the potential rate of return on various investments and choose those where the money will return the fastest. We leave out riskier investments, such as those designed to test a new product line in the market.

Of course, investment decisions are influenced by many different factors, one of which may be, for example, the development strategy in the context of at least the supply of new employees in the labor market.

A manufacturing company, like any other business, can reduce expenses, but is unable to do so completely (unless it goes out of business). Just as in the pyramid of human needs, the same is true in an organization. There are expenses that are necessary, there are those that are profitable (see ROI), those that must be realized (to preemptively ensure greater security of operations in the future) and those that can be temporarily (or completely) abandoned.

Returning to our Purchasing Manager’s Index. When interpreting the index, one must take into account that readings in the form of surveys are taken once a month. Hence, the result we get as an indicator refers to what happened in the preceding month. Be that as it may, it is one of the earliest macroeconomic indicators available, on the basis of which it is possible to draw some conclusions about the state of the economy for a given period.

This does not change the fact that reduced investment and spending results in less circulation of money in the economy, which in turn contributes to stunted growth, affecting many of the organizations that make up the global value chain.

After all, every manufacturing company uses a range of services from catering and hospitality, to integrators, construction, accounting and business analysis.

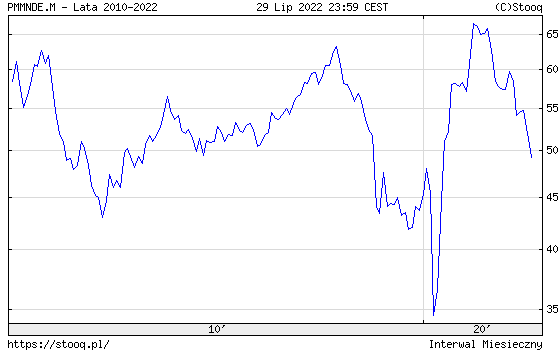

As I mentioned earlier, we have a positive ratio of the difference between exports and imports, and our largest trading partner is Germany. With the country across our western border, we have a positive trade balance (we export more to Germany than we import from it) and rank fifth among the largest trading partners.

Germany accounts for 29% of our exports, so that an economic downturn in that country has a direct bearing on the condition in our country. Another historically confirmed principle can be made repeatedly (with different trading partners, in different configurations).

Namely, the deterioration of the economic situation forces greater protectionism. Greater focus on investment within one’s own country contributes to reducing investment somewhere else.

In July 2022, they recorded a negative trade balance with other countries for the first time since 1991. This means that more was imported than exported. Will this value persist in the long term? We’ll see…

There are two scenarios:

Many factors depend on how this plays out. This does not change the fact that, in the context of the condition of our economy, it is also worth keeping an eye on what is happening across the western border.

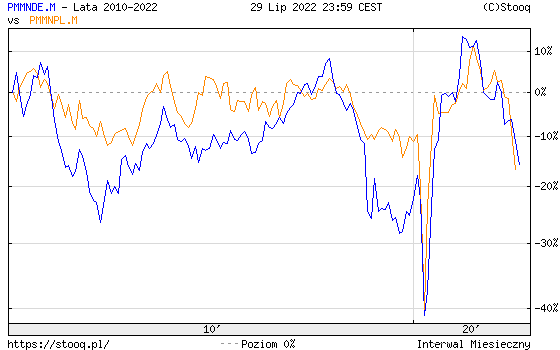

Let us then take a look at a comparison of the course of the PMI for Germany:

What is striking is that the course is quite similar to what we are facing in our country. With one correction… at this point the decline in our country is deeper.

Did the war with Ukraine contribute to this? Probably to a large extent.

Did supply chains and our place in the global value-building chain have an impact? Yes. That doesn’t change the fact that I think it’s worth tracking a couple of both indicators.

Why?

Perhaps a chart that shows both indicators will be of some help.

Many parallels can be seen here, but two things in particular may catch your eye:

Summary

Of course, he is applying some simplifications for the purposes of this short (or medium-long) entry. However, I hope I have explained what PMI is and my point of view related to its interpretation.

What I’d like you to remember is that no matter what industry you’re in (after all, it doesn’t have to be Manufacturing), to a large extent PMI can show you the trend and dynamics of change that your business will experience. By planning ahead, you thus use negative (or positive) sentiment as an opportunity rather than a threat.

If you found this text interesting, I cordially invite you to read other articles on my blog and to follow my daily posts on Linkedin.